Quiz Answer Key and Fun Facts

1. What happens to public preferences with regards to bonds and money during a liquidity trap at the zero lower bound?

2. When the liquidity trap is in place, what kind of stimulative policy is ineffective?

3. How does conventional monetary policy, which in the US means injecting cash into the economy by the Federal Reserve by buying bonds from the market, usually stimulate the economy?

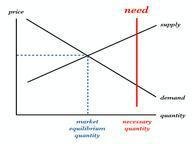

4. Why is a Fiscal Stimulus effective in a liquidity trap?

5. Whose masterful theories, later polished by the technical master John Hicks, led to the first real insights into the liquidity trap?

6. Which nation's economy suffered the wrath of the liquidity trap during the 1990s, causing, as some say, the 'lost decade' of growth?

7. What usually brings about the onset of a liquidity trap?

8. Which Taiwanese economist is an expert on the Balance Sheet Recession, and the author of a 2011 research paper titled "The world in balance sheet recession: Causes, cure, and politics" which went viral on the web in the economic/financial circles?

9. What monetary phenomenon is accompanied with a liquidity trap?

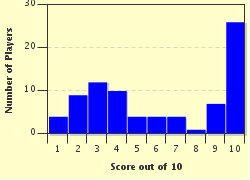

10. In regular times, increased aggregate __________ is usually good for GDP growth in the medium run, and even if it is too high, it does not do too much damage. In a liquidity trap brought on by a balance sheet recession, however, increased ___________ can do a lot of damage to both the short run and the medium run growth rate of GDP. Fill in the blank.

Source: Author

harsh_skm

This quiz was reviewed by FunTrivia editor

stedman before going online.

Any errors found in FunTrivia content are routinely corrected through our feedback system.